Accountability

Legislation, Functions, and Powers

Enabling legislation

The Australian War Memorial is established as a corporation by the Australian War Memorial Act 1980 (the Act). The functions of the Memorial and the powers of the Memorial, the Minister, the Council, the Chair, and the Director are outlined in the Act.

Functions of the Memorial

The functions of the Memorial are detailed in subsection 5(1) of the Act. They are:

(a) to maintain and develop the national memorial referred to in subsection 6(1) of the Australian War Memorial Act 1980 as a national memorial to Australians who have died:

(i) on or as a result of active service; or

(ii) as a result of any war or warlike operations in which Australians have been on active service;

(b) to develop and maintain, as an integral part of the national memorial referred to in paragraph (a), a National Collection of historical material;

(c) to exhibit, or to make available for exhibition by others, historical material from the memorial collection or historical material that is otherwise in the possession of the Memorial;

(d) to conduct, arrange for, and assist research into matters pertaining to Australian military history; and

(e) to disseminate information relating to:

(i) Australian military history;

(ii) the national memorial referred to in paragraph (a);

(iii) the memorial collection; and

(iv) the Memorial and its functions.

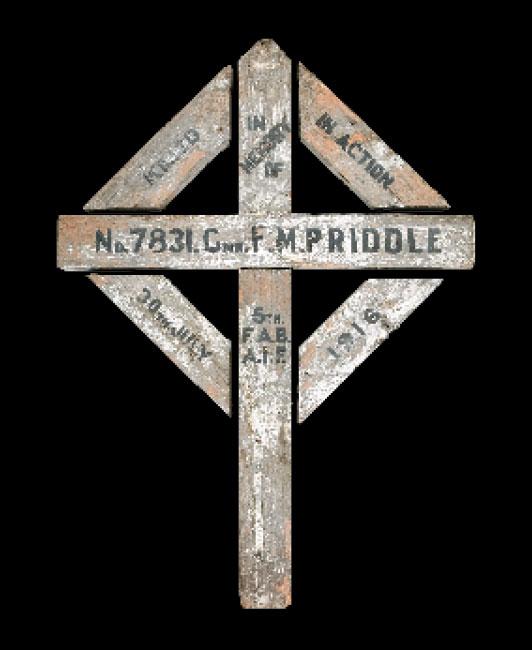

This wooden gravemarker was made by the mates of Gunner Frederick Priddle, who was killed in action at Pozieres, France, in 1916. The cross was recovered by Priddle's father after the war. RELAWM12223

Powers of the Memorial

The powers of the Memorial are detailed in section 6 of the Act. They are:

to do all things necessary or convenient to be done for or in connection with the performance of its functions, including the power:

(a) to purchase, take on hire, accept as a gift, or take on deposit or loan historical material;

(b) to lend or hire out or otherwise deal with (other than by way of disposal) historical material;

(c) to accept gifts, devises, bequests, or assignments made to the Memorial, whether on trust or otherwise, and whether unconditionally or subject to a condition, to act as a trustee or to comply with the condition, as the case may be;

(d) to collect and make available (whether in writing or in any other form and whether by sale or otherwise) information relating to Australian military history;

(e) to make available (whether by sale or otherwise) reproductions, replicas, or other representations (whether in writing or in any other form) of historical material;

(f) to make available (whether in writing or in any other form and whether by sale or otherwise) information relating to the Memorial and its functions;

(g) to provide facilities to stimulate interest in Australian military history;

(h) to assist educational institutions in matters relating to Australian military history;

(j) to train members of the staff of the Memorial, and other such persons as the Council approves, in developing, caring for, and undertaking research in relation to the Memorial collection;

(k) to assist, on request, in the creation and maintenance of military museums in Defence Force establishments;

(m) to occupy, use, and control any land or building owned or held under lease by the Commonwealth and made available to the Memorial under section 7;

(n) to erect buildings;

(o) to purchase or take on hire, or to accept as a gift or on deposit or loan, and to dispose of or otherwise deal with furnishing, equipment, and other goods;

(p) to act as trustee of monies or other property vested in the Memorial on trust; and

(q) to act on behalf of the Commonwealth or of an authority of the Commonwealth in the administration of a trust relating to historical material or related matters.

Responsible Minister

The Minister for Veterans' Affairs has portfolio responsibility for the Memorial. Senator the Honourable Michael Ronaldson was the minister responsible for the Memorial for 2014—15.

Powers of the Minister

The Minister has the following powers under the Act:

(a) to make available to the Memorial for the purposes of the Memorial land owned or held under lease by the Commonwealth, and any building, structure or other improvements on that land [subsection 7(1)];

(b) on behalf of the Commonwealth, to make arrangements, in writing, with the Memorial for:

(i) the transfer of the ownership of historical material from the Commonwealth to the Memorial for the purpose of inclusion of the material in the Memorial's collection;

(ii) the deposit in the custody of the Memorial of historical material owned by the Commonwealth; and

(iii) the transfer to the Memorial of the ownership of, or the deposit in the custody of the Memorial of, such other goods or equipment owned by the Commonwealth as he or she considers to be of use to the Memorial, upon such terms and conditions as are specified in the arrangement [subsection 7(2)].

(c) to approve the disposal of historical material if the value of that material exceeds $5,000 [subsection 8(4)];

(d) to approve the appointment of a deputy to a member of Council [subsection 12(1)];

(e) to convene a meeting of Council at any time [subsection 17(2)];

(f) to grant leave of absence to the Director [section 23];

(g) to appoint a person to act in place of the Director, determine terms and conditions of the appointment, and terminate such an appointment [section 26];

(h) to approve contracts under which the Memorial is to pay or receive:

(i) in the case of historical material, an amount exceeding $250,000*; or

(ii) in any other case an amount exceeding $150,000* [section 35]; and

(i) to delegate his or her powers under the Act [section 39].

* Note: the financial limits in this clause were amended by a Regulation to $1,000,000 for both historical material and any other case.

Internal and External Audits

Internal audit

The Memorial's internal audit services are outsourced to PricewaterhouseCoopers.

The Internal Audit Plan 2014—15 was approved by Council in May 2014 and work was completed as follows:

- Risk management review of major events planning and management

- Work health and safety management and compliance

- Review of collection management — high-risk items

The reviews resulted in no major concerns or weaknesses being identified. Minor recommended actions have been addressed or incorporated into the 2015—16 Business Plan.

The Internal Audit Plan 2015—16 was approved by Council in May 2015. The new plan will include:

- Review of collection management in the Research Centre

- Review and update of the Fraud Risk Assessment and Fraud Control Plan

- Review of collection management — high-value and high-risk items

- Review of IT security and infrastructure

- Review of systems, controls, and procedures to manage staff entitlements

External audit

The audit of the 2014—15 Financial Statements was undertaken by Ernst & Young on behalf of the ANAO and resulted in a favourable report and unqualified audit certificate. The ANAO audit certificate for the Memorial's 2014—15 Financial Statements is at page 68.

Fraud Control

As required by the Commonwealth Fraud Control Guidelines 2011, the Memorial implements practices and procedures for effective fraud control. During 2014—15 the Memorial implemented the prevention, detection, and reporting procedures and processes as outlined in the Memorial's Fraud Control Plan 2014—17, which is based on the Fraud Risk Assessment undertaken in December 2010. All reasonable measures were taken to minimise the incidence of fraud at the Memorial.

The Memorial has identified one significant fraud risk. It relates to the potential loss of collection items in storage. The strategies in place to manage this risk include:

- continuous improvements to the stocktake program;

- adherence to collection movement and security plans;

- high-quality security arrangements with controlled access; and

- continual pursuit of funding to ensure regular improvements to storage area security systems and stocktake procedures.

There were no fraud incidents reported during 2014—15.

An enterprise-wide Fraud Risk Assessment was undertaken in January 2014 and the Fraud Control Plan was updated for 2014—17. One significant fraud risk was identified — the misuse of entitlements including leave, flex, and time off in lieu. The Head of Human Resources is responsible for ensuring controls are in place and for reporting against them every six months. Controls include:

- a formal leave approval process in place;

- reconciliation of staff absences to leave applications submitted;

- timely updating of leave records;

- managers/supervisors are supported to proactively manage staff flex leave balances; and

- regular undertaking of reviews for spot audits and controls for leave and entitlements.

Effects of Ministerial Directions

Government policy order under section 22 of the Public Governance, Performance and Accountability Act 2013

Under section 22 of the Public Governance, Performance and Accountability Act 2013 Council must ensure that the Memorial complies with the Government Policy Order to the extent that the Order applies to the authority. There are no General Policy Orders currently in effect.

Indemnities and Insurance Premiums

The total insurance premium for 2014—15 was $278,762.65 (excluding GST), which remained relatively steady when compared to the premium for 2013—14. This figure includes the benchmarking discount of $24,042.75. The policy provided comprehensive cover for property and general liability (including professional indemnity), with the premiums being $161,531.97 and $140,383.78 respectively. Council members are provided with indemnity insurance through directors' and officers' liability cover.

Legal Actions

There were no legal actions taken against the Memorial during 2014—15.

Ombudsman

No issues were raised with the Ombudsman during 2014—15.

Social Justice and Equity

The Memorial is committed to social justice and equity and aims to provide a high level of public access to its physical grounds, commemorative ceremonies, and public programs designed to increase understanding of the Australian experience of war and its impact on Australian society. The Memorial undertakes regular research studies to ensure it is informed on the changing needs of its diverse national and international audience.

The Memorial identifies audience groups and specific needs through varied and dedicated visitor research and evaluation. The Memorial regularly surveys its visitors to identify and monitor how well needs are being met. Results for 2014—15 indicate:

- About 3.4 per cent of the Memorial's general visitors have a disability.

- The Memorial's facilities and services for disabled visitors and their carers were rated very highly by those who used them (88 per cent rating of very satisfied).

- Among the visitors who used facilities and services for people with disabilities, the following proportions gave a rating of satisfied or very satisfied:

- 98 per cent — mobility-impaired access into the building (remains consistent with ratings from 2013—14)

- 97 per cent — mobility-impaired access within galleries and between floors (down from 98 per cent)

- 90 per cent — accessible toilets (remains consistent with ratings from 2013—14)

- 81 per cent — free wheelchairs and walkers (down from 90 per cent)

- 93 per cent — mobility-impaired parking (up from 84 per cent)

- These findings indicate that satisfaction with most disabled facilities and services, with the exception of the provision of free equipment (e.g. walking aids), has increased or remained consistent when compared to the previous year. The percentage of Australian visitors identifying as Aboriginal or Torres Strait Islander people (three per cent of the Australian population) increased to 1.5 per cent (up from one per cent). Indigenous Australians were just as satisfied (100 per cent positive satisfaction rating) by their visit to the Memorial as non—Indigenous Australians (99 per cent positive satisfaction rating).

- About 28 per cent of Australian visitors were born overseas — a slightly higher proportion than that found in the Australian population (27.7 per cent). As in previous years, satisfaction levels remained equal for all Australian visitors regardless of their country of birth.

- About 17 per cent of Australian visitors speak a language other than English at home (up from 15 per cent), a lower percentage than that found in the Australian population (19 per cent). Those Australians who spoke solely English at home were more likely to be very satisfied (85 per cent) with their visit than those visitors who spoke another language at home (75 per cent).

Advertising and Market Research Expenditure

In accordance with section 311A of the Commonwealth Electoral Act 1918, the following is a summary of amounts paid by the Memorial to advertising agencies, market research organisations, and media advertising organisations. As required, particulars of payments of less than $10,000 have not been included. The Memorial did not pay for the services of any polling or direct mail organisations.

|

Name |

Services provided |

Amount paid |

|---|---|---|

|

WIN Television NSW Pty Ltd |

General Memorial advertising |

$83,838.00 |

|

Prime Media Group Limited |

General Memorial advertising |

$57,170.00 |

|

Fairfax Media |

General Memorial advertising |

$42,772.39 |

|

Southern Cross Austereo |

General Memorial advertising |

$42,264.00 |

|

Wingrove Design |

General Memorial advertising |

$32,940.00 |

|

Mediaheads |

General Memorial advertising |

$30,000.00 |

|

oOH! Media Pty Limited |

General Memorial advertising |

$27,784.00 |

|

Hardie Grant Magazines |

General Memorial advertising |

$22,750.00 |

|

Canberra FM Radio Pty Ltd |

General Memorial advertising |

$10,180.00 |

|

Nationwide News Pty Ltd |

General Memorial advertising |

$10,000.00 |

|

Val Morgan & Co. (Aust.) Pty Ltd |

General Memorial advertising |

$10,000.00 |

|

Seek |

Recruitment advertising |

$3,275.00 |

|

Advertising expenditure |

$369,698.39 |

|

|

Market research expenditure |

Nil |

|

|

Total |

$369,698.39 |

Freedom of Information Act 1982

The Memorial publishes a broad range of information on its website in compliance with the Information Publication Scheme (IPS), which was established under Part 2 of the Freedom of Information Act 1982 and commenced on 1 May 2011. The Memorial's IPS entry can be accessed at: http:// www.awm.gov.au/about/information-publication-scheme.

As part of its IPS entry, the Memorial publishes an Agency Plan on its website, available at: http://www.awm.gov.au/about/AWM-IPS_Agency_Plan.pdf.

The purpose of the Memorial's Agency Plan is to show what information the Memorial proposes to publish, how and to whom the information will be made available, and how the Memorial will otherwise comply with the IPS requirements.

Categories of documents

The Memorial has custody of four categories of documents which are treated differently for the purposes of the Freedom of Information Act 1982 (the FOI Act).

The four categories are:

(a) Administrative files and papers relating to all aspects of the Memorial's functions. These are subject to the FOI Act, and charges relating to the provision of these are applied and calculated in accordance with the nature and extent of the request.

(b) Items in the Memorial collection within the meaning of the Australian War Memorial Act 1980, other than documents placed in the Memorial collection by any agency. By virtue of subsection 13(1) of the FOI Act, these are not deemed to be documents of an agency, and therefore are not subject to the provisions of the FOI Act. They are, however, made available to the public as part of the Memorial's public reference facility.

(c) Items in the Memorial collection, within the meaning of the Australian War Memorial Act 1980, that have been placed in the collection by or on behalf of an agency. By virtue of subsection 13(2) of the FOI Act these are deemed for the purposes of the FOI Act to be in the possession of the agency that placed them in the Memorial collection. Access to these documents under the FOI Act is through the controlling agency.

(d) Commonwealth records owned by other agencies but in the custody of the Memorial. These are documents of the controlling agency and access to them under the FOI Act is through that agency.

Facilities for access

The Memorial caters for public access to its collections, with reading rooms and staff available to assist with reference inquiries. The Memorial's Research Centre specialises in the provision of public reference services. The facilities are available to any member of the public having gained approval for access to documents under the FOI Act. The access point at which members of the public may make inquiries on Freedom of Information (FOI) matters, submit formal requests for access to documents, or inspect documents to which access has been granted, is given below. The access point is open for business from 8.30 am to 4.51 pm, Monday to Friday (excluding public holidays). Information about access for people with disabilities can be obtained by contacting the FOI officer at the access point given below.

FOI procedures and initial contact points

Enquiries may be made in writing, by telephone, or in person at the official FOI access point given below. It is suggested that enquirers provide a contact telephone number.

Reception Desk

Australian War Memorial

Treloar Crescent

CAMPBELL ACT 2612

or

GPO Box 345

CANBERRA ACT 2601

Tel: (02) 6243 4290

If difficulty arises within the Memorial in identifying a document or in providing access in the form requested, an officer of the Memorial will contact the applicant with a view to resolving the difficulty. In consultation with applicants, documents will be made available as follows:

(a) by mail to an address specified by the applicant;

(b) at the official FOI access point; or

(c) at the information access office located within the regional office of the National Archives of Australia nearest to the applicant's normal place of residence.

Officers authorised to make decisions under the Freedom of Information Act 1982

The classification and designation of officers authorised to approve and deny access to documents, to impose charges, and to remit charges and application fees under the FOI Act and FOI (Charges) Regulations are set out below:

Assistant Director and Branch Head

National Collection

Senior Executive Band 1

Assistant Director and Branch Head

Public Programs

Senior Executive Band 1

Assistant Director and Branch Head

Corporate Services

Senior Executive Band 1

Executive Officer

Corporate Services

Australian Public Service Class 6

Executive Officer

National Collection

Australian Public Service Class 6

Executive Officer

Public Programs

Australian Public Service Class 6

The classification and designation of officers authorised to conduct an internal review under section 54 of the FOI Act are set out below:

Assistant Director and Branch Head

National Collection

Senior Executive Band 1

Assistant Director and Branch Head

Public Programs

Senior Executive Band 1

Assistant Director and Branch Head

Corporate Services

Senior Executive Band 1

Freedom of Information Act 1982, statistics 2014—15

In 2014—15 the Memorial received three requests for access to documents under the FOI Act. One request was granted in part, with all charges waived. No documents were found for one request and one was deemed to be exempt. The matter referred to the Administration Appeals Tribunal in the previous year was finalised in February 2015.

FOI Statistics Summary 2014—15

|

Received |

Granted in full |

Granted in part |

No documents found |

Withdrawn |

Exempt |

Refused on resource grounds |

|---|---|---|---|---|---|---|

|

3 |

0 |

1 |

1 |

0 |

1 |

0 |

Environmental Protection and Biodiversity Conservation (EPBC) Act 1999, Section 516A Statement

In accordance with section 516A of the Environmental Protection and Biodiversity Conservation (EPBC) Act 1999 (the EPBC Act), Australian government agencies are required to include in their annual reports information detailing the environmental performance of the organisation and the organisation's contribution to ecologically sustainable development. This remains a key objective for the Memorial and is being applied to the development of plans for the enhancement and ongoing maintenance of the Memorial's buildings and its operations. The Memorial does not administer any legislation nor does it have any appropriation directly related to the principles of environmental sustainability and development. Accordingly, the Memorial's involvement relates to environmental practices within the Memorial. Social and equitable practices are included in the Memorial's Teamwork Agreement 2011—14 and will be included in the next Teamwork Agreement, which is currently being negotiated.

Energy consumption and environmental management

Consumption of electricity, gas, and water continues to be monitored closely and is a priority for the Memorial, with gas and electricity consumption remaining close to trend. The refinement of the control strategy for building climate control is ongoing, with emphasis still on managing temperature and humidity parameters to efficiently achieve both material conservation and energy efficiency needs.

Work on the Memorial's Lighting Master Plan was completed in time for Anzac Day 2015 and has greatly enhanced the Main Building's facade appearance, emphasising its architectural features while still achieving major energy savings compared to those existing currently.

Other energy-saving initiatives undertaken include the electronic monitoring of a number of gas sub-meters for the Main Building. Following on from the electronic monitoring of both gas and electricity meters in the Main Building, alarms have now been installed to advise if consumption is outside set parameters. Planning is well underway for the Main Building's remaining gas sub-meters to also be included. The Heating Ventilation and Air-conditioning (HVAC) system of the Treloar A building, including the electrical switchboards, has been completely upgraded. Included in this upgrade are electronic sub-meters, which are scheduled to be attached to the Building Management System to allow a proactive response to any consumption spikes. Fine-tuning of the new system continues.

The recycling of paper, cardboard, glass, plastic bottles, toner cartridges, and fluorescent tubes in the administration areas continues. The provision of recycling facilities for public events in the Memorial's grounds, including Anzac Day and Remembrance Day, is ongoing. In addition, the recycling of old display lighting in the Memorial's Main Building has commenced.

The replacement of gallery lighting with more energy-efficient lighting is ongoing, with electricity savings beginning to be realised.

Heritage management

The Memorial's endorsed Heritage Management Plan (HMP) continues to guide management of the Memorial's heritage precinct and, when required, heritage specialists continue to provide advice in regard to proposed building works in heritage-sensitive areas.

Bird-deterrent installations used around the Main Building continue to be refined.

Ongoing maintenance of the Memorial building fabric continues and includes minor repairs to the stonework and the implementation of a stonework-cleaning regime. This in turn includes the application of a biocide to reduce fungal and algal growth.

Other general heritage conservation activities undertaken include regular conservation and cleaning of key sculptural elements. Before Anzac Day a major clean of sculptures and plinths was undertaken. This was in addition to a clean of the stonework in the Commemorative Area and the Main Building tower, and general cleaning of the stone facade of the Memorial's Main Building.

In order to assist with its longevity, regular maintenance of the Lone Pine tree (Pinus halepensis) continues. The new Lone Pine tree, planted by Their Royal Highnesses The Duke and Duchess of Cambridge on Anzac Day 2014, remains in a healthy state, assisted by the fence and bird netting. It is anticipated that this tree will have developed significantly when the original tree reaches senescence.

Work Health and Safety

Executive commitment

The Memorial is committed to safeguarding the health and safety of its employees, workers, and visitors by providing and maintaining a safe working environment. The Memorial aims to eliminate all preventable work-related injuries and illnesses through systematic management. Furthermore, the Memorial is committed to supporting and promoting the holistic wellbeing of its employees. In 2014 the Memorial completed a Work Health and Safety System Audit, and system improvements have been integrated into a 2015—16 Work Health and Safety Improvement Plan. In addition, the Senior Management Group attended a due diligence briefing in order to increase skills and capabilities in work health and safety.

Work Health and Safety Committee

The Work Health and Safety Committee meets four times per year and assists the Memorial in developing, implementing, and reviewing measures designed to protect the health and safety of our workers and visitors. The committee is made up of worker and management representatives, and provides one of the key consultation mechanisms with workers in accordance with relevant legislation.

The Memorial's work health and safety function is managed through human resources, with assistance from professional experts who provide advice to the committee, assist with hazard and incident investigations and case management, and provide relevant training as required. In 2014 a program was conducted across the Memorial for the re-election of health and safety representatives.

Health and Wellbeing Program

The Memorial promotes health awareness among its employees by delivering an annual Health and Wellbeing Program. This is focused on health and lifestyle initiatives to create positive health changes for workers. Employee consultation is a key element of the program and staff participated in a Health and Wellbeing Survey in June 2015 to assist with development of the 2015—16 Program. This year programs included staff workshops to inform the development of a work health and safety framework, with particular emphasis on mental health and wellbeing. To support this framework, ongoing programs of mental health awareness for managers and supervisors, and mental health first aid for Security and Front of House staff, were also implemented. The aim of these programs is to increase our agility and resilience as an organisation and validate the unique working environment of the Memorial.

Other programs included quit smoking sessions and flu vaccinations.

Ongoing initiatives

In 2015 the Memorial implemented a program of training workshops on risk assessment and safe work method statements for managers, supervisors, and staff. This program is part of the Work Health and Safety Improvement Plan, with an enhanced focus on documented safety risk management and contractor management.

First aid officers are located throughout the Memorial buildings to ensure immediate assistance is available when required. Emergency response support has also been enhanced with additional cardiac defibrillators purchased for the Campbell and Mitchell sites.

The Memorial has a no-tolerance approach to bullying and harassment. The Memorial also has a number of contacts available should an employee or manager require advice regarding an instance of bullying or harassment. These include harassment contact officers across all business areas and the Employee Assistance Program. The Memorial addresses formal and informal allegations of bullying or harassment promptly and sensitively.

Outcome measures

The Memorial has maintained a focus on prompt reporting and management of accidents and incidents. Implementation of an early intervention program has delivered increased support for employees and has shown improved injury recovery rates. Implementation of enhanced early intervention and hazard identification and risk assessment processes is under way and aims to recognise cost benefits going forward.

No directions or notices under the Work Health and Safety Act 2011 were given to the Memorial.

Visitors remember their friends and families during the annual Aged Care wreathlaying ceremony. The Memorial holds many such ceremonies, small and large, throughout the year.

The Research Centre's Jennifer Milward assists a client with family research in the Memorial's Reading Room. Memorial staff regularly assist members of the public with enquires relating to family history, military history, and collection material.

The embroidered cross-belt pouch of an officer of the New South Wales Volunteer Artillery, c. 1880—1900. REL/06911

REPORT by the auditor-general and financial statements

STATEMENT OF COMPREHENSIVE INCOME for the period ended 30 June 2015

|

Note |

2015 |

2014 |

|

|---|---|---|---|

|

$ |

$ |

||

|

EXPENSES |

|||

|

Employee benefits |

4A |

23 329 252 |

25 537 528 |

|

Supplier |

4B |

24 488 163 |

18 535 551 |

|

Depreciation and amortisation |

4C |

19 824 597 |

18 892 459 |

|

Write-down and impairment of assets |

4D |

60 531 |

5 364 |

|

Losses from asset sales |

6 761 |

20 707 |

|

|

Total expenses |

67 709 304 |

62 991 609 |

|

|

OWN-SOURCE INCOME |

|||

|

Own-source revenue |

|||

|

Sale of goods and rendering of services |

5A |

4 975 521 |

4 361 496 |

|

Interest from deposits |

2 558 612 |

3 061 152 |

|

|

Resources received free of charge |

5B |

796 508 |

1 093 073 |

|

Donations and sponsorships |

5C |

10 819 872 |

3 418 534 |

|

Other revenue |

5D |

380 666 |

213 398 |

|

Total own-source revenue |

19 531 179 |

12 147 653 |

|

|

Gains |

|||

|

Gains from sale of assets |

65 296 |

- |

|

|

Total gains |

65 296 |

- |

|

|

Total own-source income |

19 596 475 |

12 147 653 |

|

|

Net cost of services |

48 112 829 |

50 843 956 |

|

|

Revenue from Government |

5E |

44 008 000 |

40 900 000 |

|

(Deficit) Surplus |

(4 104 829) |

(9 943 956) |

|

|

OTHER COMPREHENSIVE INCOME Items not subject to subsequent reclassification to profit or loss |

|||

|

Changes in asset revaluation surplus |

4 423 109 |

16 901 015 |

|

|

Total other comprehensive income |

4 423 109 |

16 901 015 |

|

|

Total comprehensive income |

3 |

318 280 |

6 957 059 |

The above statement should be read in conjunction with the accompanying notes.

|

Note |

2015 |

2014 |

||

|---|---|---|---|---|

|

$ |

$ |

|||

|

ASSETS |

||||

|

Financial assets |

||||

|

Cash and cash equivalents |

7A |

7 109 567 |

5 709 642 |

|

|

Trade and other receivables |

7B |

1 045 213 |

1 278 269 |

|

|

Investments |

7C |

61 000 000 |

67 000 000 |

|

|

Accrued interest |

1 190 859 |

1 513 097 |

||

|

Total financial assets |

70 345 639 |

75 501 008 |

||

|

Non-financial assets |

||||

|

Land and buildings |

8A, F |

143 489 809 |

139 869 189 |

|

|

Property, plant and equipment |

8B, F |

5 679 510 |

5 026 042 |

|

|

Heritage and cultural assets |

8C, F |

1 018 562 197 |

1 020 279 755 |

|

|

Exhibitions |

8D, F |

42 574 569 |

28 361 649 |

|

|

Intangibles |

8E, F |

4 664 104 |

4 949 241 |

|

|

Inventories |

734 047 |

819 668 |

||

|

Prepayments |

8G |

656 804 |

1 158 581 |

|

|

Total non-financial assets |

1 216 361 040 |

1 200 464 125 |

||

|

Total assets |

1 286 706 679 |

1 275 965 133 |

||

|

LIABILITIES |

||||

|

Payables |

||||

|

Suppliers |

9A |

1 480 724 |

3 169 776 |

|

|

Other payables |

9B |

1 025 710 |

1 151 434 |

|

|

Total payables |

2 506 434 |

4 321 210 |

||

|

Provisions |

||||

|

Employee provisions |

10A |

9 004 486 |

9 210 445 |

|

|

Total provisions |

9 004 486 |

9 210 445 |

||

|

Total liabilities |

11 510 920 |

13 531 655 |

||

|

NET ASSETS |

1 275 195 759 |

1 262 433 478 |

||

|

EQUITY |

||||

|

Contributed equity |

96 152 000 |

83 708 000 |

||

|

Asset revaluation reserves |

620 479 581 |

616 056 472 |

||

|

Retained surplus |

558 564 178 |

562 669 006 |

||

|

Total equity |

1 275 195 759 |

1 262 433 478 |

The above statement should be read in conjunction with the accompanying notes.

STATEMENT OF FINANCIAL POSITION as at 30 June 2015

STATEMENT OF CHANGES IN EQUITY for the period ended 30 June 2015

|

Retained earnings |

Asset revaluation surplus |

Contributed equity/capital |

Total equity |

|||||

|---|---|---|---|---|---|---|---|---|

|

2015 |

2014 |

2015 |

2014 |

2015 |

2014 |

2015 |

2014 |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|

|

Opening balance 1 July |

||||||||

|

Balance carried forward from previous period |

562 669 006 |

572 612 962 |

616 056 472 |

599 155 457 |

83 708 000 |

58 450 000 |

1 262 433 478 |

1 230 218 419 |

|

Adjusted opening balance |

562 669 006 |

572 612 962 |

616 056 472 |

599 155 457 |

83 708 000 |

58 450 000 |

1 262 433 478 |

1 230 218 419 |

|

Comprehensive income |

||||||||

|

Surplus (Deficit) for the period |

(4 104 829) |

(9 943 956) |

- |

- |

- |

- |

(4 104 829) |

(9 943 956) |

|

Other comprehensive income |

- |

- |

4 423 109 |

16 901 015 |

- |

- |

4 423 109 |

16 901 015 |

|

Total comprehensive income attributable to the Australian Government |

(4 104 829) |

(9 943 956) |

4 423 109 |

16 901 015 |

- |

- |

318 280 |

6 957 059 |

|

Transactions with owners |

||||||||

|

Contributions by owners |

||||||||

|

Equity injection |

- |

- |

- |

- |

12 444 000 |

25 258 000 |

12 444 000 |

25 258 000 |

|

Total transactions with owners |

- |

- |

- |

- |

12 444 000 |

25 258 000 |

12 444 000 |

25 258 000 |

|

Closing balance as at 30 June |

558 564 178 |

562 669 006 |

620 479 581 |

616 056 472 |

96 152 000 |

83 708 000 |

1 275 195 759 |

1 262 433 478 |

The above statement should be read in conjunction with the accompanying notes.

|

|

Note |

2015 |

2014 |

|---|---|---|---|

|

$ |

$ |

||

|

OPERATING ACTIVITIES |

|||

|

Cash received |

|||

|

Receipts from Government |

44 008 000 |

40 900 000 |

|

|

Sales of goods and rendering of services |

4 728 249 |

4 217 294 |

|

|

Interest |

2 880 850 |

2 778 488 |

|

|

Net GST received |

3 658 040 |

3 278 957 |

|

|

Donations and sponsorships |

10 331 171 |

3 210 384 |

|

|

Other |

266 931 |

213 398 |

|

|

Total cash received |

65 873 241 |

54 598 521 |

|

|

Cash used |

|||

|

Employees |

(23 439 211) |

(24 766 320) |

|

|

Suppliers |

(28 140 412) |

(20 057 764) |

|

|

Total cash used |

(51 579 623) |

(44 824 084) |

|

|

Net cash from operating activities |

11 |

14 293 618 |

9 774 437 |

|

INVESTING ACTIVITIES |

|||

|

Cash received |

|||

|

Proceeds from sales of property, plant and equipment |

65 296 |

2 210 |

|

|

Investments |

89 000 000 |

81 500 000 |

|

|

Total cash received |

89 065 296 |

81 502 210 |

|

|

Cash used |

|||

|

Purchase of property, plant, equipment and intangibles |

(31 402 990) |

(30 697 602) |

|

|

Investments |

(83 000 000) |

(82 500 000) |

|

|

Total cash used |

(114 402 990) |

(113 197 602) |

|

|

Net cash used by investing activities |

(25 337 693) |

(31 695 392) |

|

|

FINANCING ACTIVITIES |

|||

|

Cash received |

|||

|

Contributed equity |

12 444 000 |

25 258 000 |

|

|

Total cash received |

12 444 000 |

25 258 000 |

|

|

Net cash from financing activities |

12 444 000 |

25 258 000 |

|

|

Net (decrease)/increase in cash held |

1 399 925 |

3 337 045 |

|

|

Cash and cash equivalents at the beginning of the reporting period |

5 709 642 |

2 372 597 |

|

|

Cash and cash equivalents at the end of the reporting period |

7A |

7 109 567 |

5 709 642 |

The above statement should be read in conjunction with the accompanying notes.

CASH FLOW STATEMENT for the period ended 30 June 2015

SCHEDULE OF COMMITMENTS as at 30 June 2015

|

Note |

2015 |

2014 |

|

|---|---|---|---|

|

$ |

$ |

||

|

By type |

|||

|

Commitments receivable |

|||

|

Rental income |

(806 438) |

- |

|

|

Sponsorship |

(591 130) |

(3 269 264) |

|

|

Grants |

(5 855 674) |

- |

|

|

Other receivables |

(643 098) |

- |

|

|

GST recoverable on commitments |

(322 292) |

(2 319 452) |

|

|

Total commitments receivable |

(8 218 632) |

(5 588 716) |

|

|

Commitments payable |

|||

|

Capital commitments |

1.18 |

||

|

Land and buildings |

68 612 |

397 820 |

|

|

Infrastructure plant and equipment |

- |

52 701 |

|

|

Exhibitions |

109 849 |

6 098 907 |

|

|

Intangibles |

46 750 |

- |

|

|

National Collection |

1 859 888 |

1 663 056 |

|

|

Total capital commitments |

2 085 099 |

8 212 484 |

|

|

Other commitments |

|||

|

Operating leases |

1.18 |

150 424 |

1 159 644 |

|

Project commitments |

19 275 |

2 644 760 |

|

|

Other |

9 186 760 |

16 766 350 |

|

|

Total other commitments |

9 356 459 |

20 570 754 |

|

|

Total commitments payable |

11 441 558 |

28 783 238 |

|

|

Net commitments by type |

3 222 926 |

23 194 522 |

|

|

By maturity |

|||

|

Commitments receivable |

|||

|

Within one year |

(3 636 129) |

(3 217 950) |

|

|

From one to five years |

(4 453 838) |

(2 370 766) |

|

|

More than five years |

(128 665) |

- |

|

|

Total commitments receivable |

(8 218 632) |

(5 588 716) |

|

|

Commitments payable |

|||

|

Capital commitments |

|||

|

Within one year |

495 714 |

6 480 548 |

|

|

From one to five years |

174 059 |

1 731 936 |

|

|

More than five years |

1 415 326 |

- |

|

|

Total capital commitments |

2 085 099 |

8 212 484 |

|

|

Operating lease commitments |

|||

|

Within one year |

92 440 |

653 593 |

|

|

From one to five years |

57 984 |

506 051 |

|

|

More than five years |

- |

- |

|

|

Total operating lease commitments |

150 424 |

1 159 644 |

|

|

Other commitments |

|||

|

Within one year |

4 624 238 |

17 244 572 |

|

|

From one to five years |

4 581 797 |

2 166 538 |

|

|

More than five years |

- |

- |

|

|

Total other commitments |

9 206 035 |

19 411 110 |

|

|

Total commitments payable |

11 441 558 |

28 783 238 |

|

|

Net commitments by maturity |

3 222 926 |

23 194 522 |

Commitments are GST inclusive where relevant.

The above statement should be read in conjunction with the accompanying notes.

|

Index to the notes to and forming part of the financial statements |

|

|---|---|

Note |

Description |

|

1 |

Summary of Significant Accounting Policies |

|

2 |

Events After the Reporting Period |

|

3 |

Net Cash Appropriation Arrangements |

|

4 |

Expenses |

|

5 |

Income |

|

6 |

Fair Value Measurement |

|

7 |

Financial Assets |

|

8 |

Non-Financial Assets |

|

9 |

Payables |

|

10 |

Provisions |

|

11 |

Cash Flow Reconciliation |

|

12 |

Contingent Assets |

|

13 |

Senior Management Remuneration |

|

14 |

Related Party Disclosures |

|

15 |

Remuneration of Auditors |

|

16 |

Financial Instruments |

|

17 |

Financial Assets Reconciliation |

|

18 |

Assets Held in Trust |

|

19 |

Reporting of Outcomes |

|

20 |

Budget Reports and Explanations of Major Variances |

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

1.1 Objectives of the Memorial

The Memorial was established by section 4 of the Australian War Memorial Act 1980 and is a not-for-profit Australian government controlled entity.

The objective and outcome of the Memorial is to assist Australians in remembering, interpreting, and understanding the Australian experience of war and its enduring impact through maintaining and developing the National Memorial, its collection and exhibition of historical material, commemorative ceremonies and research.

The continued existence of the Memorial in its present form and with its present programs is dependent on government policy and on continued funding by parliament for the Memorial's administration and programs.

1.2 Basis of preparation of the Financial Statements

The financial statements are general purpose financial statements and are required by section 42 of the Public Governance, Performance and Accountability Act 2013.

The financial statements have been prepared in accordance with:

- Financial Reporting Rule (FRR) for reporting periods ending on or after 1 July 2014; and

- Australian Accounting Standards and Interpretations issued by the Australian Accounting Standards Board (AASB) that apply for the reporting period.

The financial statements have been prepared on an accrual basis and are in accordance with the historical cost convention, except for certain assets and liabilities at fair value. Except where stated, no allowance is made for the effect of changing prices on the results or the financial position.

The financial statements are presented in Australian dollars and where specified, some values are rounded to the nearest thousand.

Unless an alternative treatment is specifically required by an accounting standard or the FRR, assets and liabilities are recognised in the statement of financial position when and only when it is probable that future economic benefits will flow to the Memorial, or a future sacrifice of economic benefits will be required and the amounts of the assets or liabilities can be reliably measured. However, assets and liabilities arising under executory contracts are not recognised unless required by an accounting standard. Liabilities and assets that are unrecognised are reported in the Schedule of Commitments or at Note 12.

Unless an alternative treatment is specifically required by an accounting standard, income and expenses are recognised in the statement of comprehensive income, when and only when the flow, consumption, or loss of economic benefits has occurred and can be reliably measured.

1.3 Significant accounting judgements and estimates

In the process of applying the accounting policies listed in this note, the Memorial has made the following judgements that have the most significant impact on the amounts recorded in the financial statements:

- The fair value of the National Collection is considered to be market selling price (where such a market exists), or depreciated replacement cost, taking into consideration the intrinsic value of historically significant objects. Owing to the size of the National Collection, a representative sample of all major categories is selected, valued and extrapolated to determine a total fair value.

- The fair value of land and buildings is considered to be the market value of similar assets, taking into account the heritage aspects of the buildings where appropriate, and using depreciated replacement cost if no active market is identified.

- The Memorial's primary liability, employee provisions, includes an estimation component in respect of long-term employee benefits measured as the present value of estimated future cash outflows.

No accounting assumptions and estimates have been identified that have a significant risk of causing a material adjustment to carrying amounts of assets and liabilities within the next accounting period.

1.4 New accounting standards

Adoption of new Australian Accounting Standard requirements

No accounting standard has been adopted earlier than the application date as stated in the standard.

The following new standards were issued by the Australian Accounting Standards Board (AASB) prior to the sign-off date, which are not expected to have a financial impact on the Memorial. They are disclosed to provide users with information about the main requirements:

- AASB 15 Revenue from Contracts with Customers (issued December 2014)

The AASB has issued new standard AASB 15. This new Standard requires reporting about the nature, amount, timing, and uncertainty of revenue and cash flows arising from a contract with a customer. The new Standard applies to reporting periods beginning on or after 1 January 2017.

The following revised and amending standards were issued by the AASB, which are relevant to the Memorial and are not expected to have a financial impact for future reporting periods. They are disclosed to provide users with information about the main requirements:

- AASB 9 Financial Instruments (issued December 2014)

This Standard incorporates the classification and measurement requirements for financial liabilities, the recognition and derecognition requirements for financial instruments and the classification and measurement requirements for financial assets. The changes will apply to reporting periods beginning on or after 1 January 2018.

- AASB 2015-2 Amendments to Australian Accounting Standards — Disclosure Initiative: Amendments to AASB 101 (AASB 7, 101, 134 and 1049) (issued January 2015)

This Standard amends AASB 101 to provide clarification regarding the disclosure requirements in AASB 101. The Standard proposes to address concerns about existing presentation and disclosure requirements and to allow entities to use judgement when applying a Standard in determining what information to disclose in their financial statements. The changes will apply to reporting periods beginning on or after 1 January 2016.

All other new standards, revised standards, interpretations and amending standards that were issued prior to the sign-off date and are applicable to future reporting periods are not expected to have a future financial impact on the Memorial.

1.5 Revenue

Revenue from the sale of goods is recognised when:

- the risks and rewards of ownership have been transferred to the buyer;

- the Memorial retains no managerial involvement in or effective control over the goods;

- the revenue and transaction costs incurred can be reliably measured; and

- it is probable that the economic benefits associated with the transaction will flow to the Memorial.

Revenue from rendering of services is recognised by reference to the stage of completion of contracts at the reporting date. The revenue is recognised when:

- the amount of revenue, stage of completion and transaction costs incurred can be reliably measured; and

- the probable economic benefits associated with the transaction will flow to the Memorial.

The stage of completion of contracts at the reporting date is determined by reference to the proportion that costs incurred to date bear to the estimated total costs of the transaction.

Receivables for goods and services, which have 30-day terms, are recognised at the nominal amounts due less any impairment allowance account. Collectability of debts is reviewed at the end of the reporting period. Allowances are made when collectability of the debt is no longer probable.

Project-specific sponsorship funding which meets the requirements of a contribution in accordance with AASB 1004 Contributions is recorded as revenue when the Memorial obtains control of the contribution or right to receive the contribution, it is probable that the economic benefits comprising the contribution will flow to the Memorial, and the amount can be measured reliably.

Interest revenue is recognised using the effective interest method as set out in AASB 139 Financial Instruments: Recognition and Measurement.

Revenues from Government

Funding received or receivable from non-corporate Commonwealth entities (appropriated to the non-corporate Commonwealth entity as a corporate Commonwealth entity payment item for payment to the Memorial) is recognised as revenue from government by the corporate Commonwealth entity unless it is in the nature of an equity injection or a loan.

1.6 Gains

Resources Received Free of Charge

Resources received free of charge are recognised as gains when, and only when, a fair value can be reliably determined and the services would have been purchased if they had not been donated. Use of those resources is recognised as an expense.

Resources received free of charge are recorded as either revenue or gains depending on their nature.

Contributions of assets at no cost of acquisition or for nominal consideration are recognised as gains at their fair value when the asset qualifies for recognition.

Sale of Assets

Gains from disposal of assets are recognised when control of the asset has passed to the buyer.

1.7 Transactions with the Government as Owner

Equity injections

Amounts appropriated that are designated as "equity injections" for a year (less any formal reductions) are recognised directly in contributed equity in that year.

1.8 Employee Benefits

Liabilities for "short-term employee benefits" (as defined in AASB 119 Employee Benefits) and termination benefits due within 12 months of the end of reporting period are measured at their nominal amounts.

The nominal amount is calculated with regard to the rates expected to be paid on settlement of the liability.

Other long-term employee benefits are measured as the present value of the estimated future cash outflows to be made in respect of services provided by employees up to the reporting date.

Leave

The liability for employee benefits includes provision for annual leave and long service leave. No provision has been made for sick leave as all sick leave is non-vesting and the average sick leave taken in future years by employees of the Memorial is estimated to be less than the annual entitlement for sick leave.

The leave liabilities are calculated on the basis of employees' remuneration at the estimated salary rates that will be applied at the time the leave is taken, including the Memorial's employer superannuation contribution rates to the extent that the leave is likely to be taken during service rather than paid out on termination.

The liability for long service leave is recognised and measured at the net present value of the estimated future cash flows to be made in respect of all employees at 30 June 2015. In determining the present value of the liability, including related on-costs, attrition rates, and pay increases through promotion and inflation have been taken into account.

Superannuation

The Memorial's staff are members of the Commonwealth Superannuation Scheme (CSS), the Public Sector Superannuation Scheme (PSS), AustralianSuper, or the PSS accumulation plan (PSSap).

The CSS and PSS are defined benefit schemes for the Australian government. The PSSap is a defined contribution scheme.

The liability for defined benefits is recognised in the financial statements of the Australian government and is settled by the Australian government in due course. This liability is reported in the Department of Finance's administered schedules and notes.

The Memorial makes employer contributions to the employees' superannuation schemes at rates determined by an actuary to be sufficient to meet the current cost to the government. The Memorial accounts for the contributions as if they were contributions to defined contribution plans.

The liability for superannuation recognised as at 30 June represents outstanding contributions for the final fortnight of the quarter.

1.9 Leases

A distinction is made between finance leases and operating leases. Finance leases effectively transfer from the lessor to the lessee substantially all the risks and rewards incidental to ownership of leased assets. An operating lease is a lease that is not a finance lease. In operating leases, the lessor effectively retains substantially all such risks and benefits.

Operating lease payments are expensed on a straight-line basis which is representative of the pattern of benefits derived from the leased assets.

The Memorial does not hold any finance leases.

1.10 Cash

Cash is recognised at its nominal amount. Cash and cash equivalents include cash on hand and any deposits in bank accounts with an original maturity of three months or less that are readily convertible to known amounts of cash and subject to insignificant risk of changes in value.

1.11 Financial Assets

The Memorial classifies its financial assets in the following categories:

- held-to-maturity investments

- receivables

The classification depends on the nature and purpose of the financial assets and is determined at the time of initial recognition. Financial assets are recognised and derecognised upon trade date.

Effective interest method

The effective interest method is a method of calculating the amortised cost of a financial asset and of allocating interest income over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset, or, where appropriate, a shorter period.

Income is recognised on an effective interest rate basis except for financial assets that are recognised at fair value through profit and loss.

Held-to-maturity investments

Non-derivative financial assets with fixed or determinable payments and fixed maturity dates that the Memorial has the positive intent and ability to hold to maturity are classified as held-to-maturity investments. Held-to-maturity investments are recorded at amortised cost using the effective interest method less impairment, with revenue recognised on an effective yield basis.

Receivables

Trade receivables and other receivables that have fixed or determinable payments that are not quoted in an active market are classified as "receivables". Receivables are measured at amortised cost using the effective interest method less impairment. Interest is recognised by applying the effective interest rate.

Impairment of financial assets

Financial assets are assessed for impairment at the end of each reporting period.

- Financial assets held at amortised cost — if there is objective evidence that an impairment loss has been incurred for receivables or held-to-maturity investments held at amortised cost, the amount of the loss is measured as the difference between the asset's carrying amount and the present value of estimated future cash flows discounted at the asset's original effective interest rate. The carrying amount is reduced by way of an allowance account. The loss is recognised in the Statement of Comprehensive Income.

1.12 Financial Liabilities

The Memorial classifies its financial liabilities as other financial liabilities. Financial liabilities are recognised and derecognised upon trade date.

Other Financial Liabilities

Supplier and other payables are recognised at amortised cost. Liabilities are recognised to the extent that the goods or services have been received (and irrespective of having been invoiced).

1.13 Acquisition of assets

Assets are recorded at cost on acquisition except as stated below. The cost of acquisition includes the fair value of assets transferred in exchange and liabilities undertaken. Financial assets are initially measured at their fair value plus transaction costs where appropriate.

Assets acquired at no cost, or for nominal consideration, are initially recognised as assets and income at their fair value at the date of acquisition. Significant donated National Collection items are recognised at the time of acquisition, and other donated collection items are brought to account at the time of revaluation.

1.14 Property, Plant and Equipment

Asset Recognition Threshold

Purchases of property, plant and equipment are recognised initially at cost in the statement of financial position, except for purchases costing less than $2,000, which are expensed in the year of acquisition (other than where they form part of a group of similar items that are significant in total).

The initial cost of an asset includes an estimate of the cost of dismantling and removing the item and restoring the site on which it is located.

Revaluations

Fair values for each class of assets are determined as shown below.

|

Asset class |

Fair value measured at: |

|---|---|

|

Land |

Market selling price |

|

Buildings |

Market selling price/depreciated replacement cost |

|

Exhibitions |

Depreciated replacement cost |

|

Plant and Equipment |

Market selling price/depreciated replacement cost |

Following initial recognition at cost, property, plant and equipment were carried at fair value less subsequent accumulated depreciation and accumulated impairment losses. Valuations were conducted with sufficient frequency to ensure that the carrying amounts of assets did not differ materially from the assets' fair values as at the reporting date. The regularity of independent valuations depended upon the volatility of movements in market values for the relevant assets.

Revaluation adjustments were made on a class basis. Any revaluation increment was credited to equity under the heading of asset revaluation reserve except to the extent that it reverses a previous revaluation decrement of the same asset class that was previously recognised in the surplus/deficit. Revaluation decrements for a class of assets were recognised directly in the surplus/deficit, except to the extent that they reversed a previous revaluation increment for that class.

Any accumulated depreciation as at the revaluation date is eliminated against the gross carrying amount of the asset and the asset restated to the revalued amount.

Depreciation

Depreciable property, plant and equipment assets are written-off to their estimated residual values over their estimated useful lives to the Memorial using, in all cases, the straight-line method of depreciation.

Depreciation rates (useful lives), residual values and methods are reviewed at each reporting date and necessary adjustments are recognised in the current reporting period, or current and future reporting periods, as appropriate.

Depreciation rates applying to each class of depreciable asset are based on the following useful lives:

|

2015 |

2014 |

|

|---|---|---|

|

Buildings and building improvements |

10 to 175 years |

10 to 175 years |

|

Plant and equipment |

2 to 30 years |

2 to 30 years |

|

Exhibitions |

4 to 20 years |

5 to 15 years |

Impairment

All assets will be assessed for impairment at 30 June 2015. Where indications of impairment exist, the asset's recoverable amount is estimated and an impairment adjustment made if the asset's recoverable amount is less than its carrying amount.

The recoverable amount of an asset is the higher of its fair value less costs of disposal and its value in use. Value in use is the present value of the future cash flows expected to be derived from the asset. Where the future economic benefit of an asset is not primarily dependent on the asset's ability to generate future cash flows, and the asset would be replaced if the Memorial were deprived of the asset, its value in use is taken to be its depreciated replacement cost.

Derecognition

An item of property, plant and equipment is derecognised upon disposal or when no further future economic benefits are expected from its use or disposal.

1.15 Heritage and Cultural Assets

The Memorial's collection of heritage and cultural assets comprises a wide range of objects relating to Australia's military history, including but not limited to:

|

|

|---|---|

|

|

|

|

|

|

Pursuant to section 8 of the Australian War Memorial Act 1980, the Memorial has the authority to dispose of heritage and cultural items which are not required as part of the National Collection, or are unfit for inclusion. Section 8 of the Australian War Memorial Act 1980 dictates the appropriate approvals to dispose of National Collection assets.

The decision whether or not to acquire or retain an item for the National Collection is based on two criteria:

1. Assessment to establish that the item is of significance to Australian military history.

2. Assessment that the benefit and resource implications of acquiring or retaining the item are acceptable.

The evaluation process ensures that the history and provenance of objects is recorded at the time of acquisition and records the significance of the item to the Australian community, provides a systematic assessment of the values of objects against the existing collection and other collecting institutions, and assists in setting priorities for collection management and conservation resources.

The Memorial's Collection Development Plan for heritage and cultural assets can be found at:

/sites/default/files/collection_development_plan.pdf

The Memorial's preservation and curatorial policies for heritage and cultural assets can be found at:

http://www.awm.gov.au/collection/conservation

Revaluations

The National Collection is carried at fair value, which is measured at depreciated replacement cost or market selling price (for items where a market exists).

Following initial recognition at cost, the National Collection is carried at fair value less accumulated depreciation and accumulated impairment losses. Valuations are conducted with sufficient frequency such that the carrying amounts of assets do not differ materially from the assets' fair values as at the reporting date. The regularity of independent valuations depends upon the volatility of movements in market values for the relevant assets.

Depreciation

All items in the National Collection are written off over their estimated useful life to the Memorial using the straight-line method of depreciation.

Depreciation rates (useful lives) have been estimated based on the condition and physical composition of items in each sub-class, and range from 5 to 600 years. Rates and methods are reviewed at each reporting date and necessary adjustments are recognised in the current, or current and future reporting periods, as appropriate.

1.16 Intangibles

The Memorial's intangibles comprise purchased software, which is carried at cost less accumulated amortisation and accumulated impairment losses.

Software is amortised on a straight-line basis over its anticipated useful life. The useful lives range from 2 to 10 years (2014: 2 to 10 years).

All software assets will be assessed for indications of impairment at 30 June 2015.

1.17 Inventories

The Memorial holds inventory for sale only, and this is reported at the lower of cost and net realisable value. Costs incurred in bringing each item of inventory to its present location and condition are assigned as follows:

- stores — average purchase cost; and

- finished goods and works-in-progress — cost of direct materials and labour plus attributable costs that are capable of being allocated on a reasonable basis.

Inventories acquired at no cost or at nominal consideration are initially measured at current replacement cost at the date of acquisition.

1.18 Commitments

Capital commitments include current undertakings and contractual payments related to the provision of items for National Collection works in progress. Other commitments are related to contracts for provision of casual staff, buildings and grounds maintenance and security services.

The Memorial in its capacity as a lessor of the property located at block 18 section 21 Mitchell (Treloar F) receives annual rent of $239,226 (adjusted for CPI annually in March). Monthly rental is payable in advance and the lease term is initially for five years with options to renew.

Commitments are GST inclusive where relevant.

The nature of operating lease commitments is as follows:

|

Nature of operating lease |

General description of leasing arrangement |

|---|---|

|

Agreements for the provision of motor vehicles |

The lessor provides pool vehicles as required. There are no purchase options available to the Memorial, and no contingent rentals exist. |

|

Lease of computer equipment |

The lessor provides all computer equipment designated as necessary in the supply contract for three years plus a further year at the Memorial's option, with a reduction of fees available. The initial equipment has, on average, a useful life of three years from the commencement of the lease. The Memorial may take out additional leases at any time during the contract period. The Memorial has an option to purchase the equipment at the end of the lease. |

1.19 Taxation

The Memorial is exempt from all forms of taxation except the Fringe Benefits Tax (FBT) and the Goods and Services Tax (GST).

Revenues, expenses and assets are recognised net of GST except:

- where the amount of GST incurred is not recoverable from the Australian Taxation Office; and

- for receivables and payables.

2. Events after the reporting period

There was no subsequent event that had the potential to significantly affect the ongoing structure and financial activities of the Memorial.

3. Net cash appropriation arrangements

|

2015 |

2014 |

|

|---|---|---|

|

$ |

$ |

|

|

Total comprehensive income less depreciation/amortisation expenses previously funded through revenue appropriations |

10 706 520 |

17 163 431 |

|

Plus: depreciation/amortisation expenses previously funded through revenue appropriation |

10 388 240 |

10 206 372 |

|

Total comprehensive income — as per the Statement of Comprehensive Income |

318 280 |

6 957 059 |

From 2010—11 the Government introduced net cash appropriation arrangements where revenue appropriations for the National Collection depreciation expenses ceased. The Memorial now receives a separate capital budget provided through equity appropriations. Capital budgets are to be appropriated in the period when cash payment for capital expenditure is required.

4. EXPENSES

4A. Employee benefits

|

Wages and salaries |

17 685 281 |

19 073 010 |

|---|---|---|

|

Superannuation |

||

|

Defined contribution plans |

1 580 692 |

1 817 641 |

|

Defined benefit plans |

1 875 252 |

1 954 690 |

|

Leave and other entitlements |

886 205 |

1 971 309 |

|

Separation and redundancies |

916 846 |

131 347 |

|

Other employee benefits |

384 976 |

589 531 |

|

Total employee benefits |

23 329 252 |

25 537 528 |

|

2015 |

2014 |

|

|---|---|---|

|

$ |

$ |

|

|

4B. Suppliers |

||

|

Goods and services supplied or rendered |

||

|

Property and support services |

5 380 553 |

5 219 040 |

|

Professional services (contractors and consultants) |

2 802 659 |

2 037 856 |

|

Staff support |

3 373 980 |

3 134 168 |

|

Advertising and promotions |

752 766 |

991 715 |

|

Cost of goods sold |

1 570 927 |

1 607 643 |

|

IT services |

871 425 |

1 037 093 |

|

Exhibitions |

6 506 819 |

1 645 768 |

|

Travel |

488 762 |

471 001 |

|

Other |

1 982 616 |

1 883 512 |

|

Total goods and services supplied or rendered |

23 730 507 |

18 027 796 |

|

Goods supplied in connection with |

||

|

Related parties |

5 222 |

172 690 |

|

External parties |

2 532 697 |

2 924 386 |

|

Total goods supplied |

2 537 919 |

3 097 076 |

|

Services rendered in connection with |

||

|

Related parties |

1 674 854 |

1 283 542 |

|

External parties |

19 517 734 |

13 647 178 |

|

Total services rendered |

21 192 588 |

14 930 720 |

|

Total goods and services supplied or rendered |

23 730 507 |

18 027 796 |

|

Other supplier expenses |

||

|

Operating lease rentals in connection with External parties — minimum lease payments |

||

|

266 722 |

323 390 |

|

|

Workers compensation expenses |

490 934 |

184 365 |

|

Total other supplier expenses |

757 656 |

507 755 |

|

Total suppliers |

24 488 163 |

18 535 551 |

4C. Depreciation and Amortisation

4D. Write-down and impairment of assets

|

2015 |

2014 |

|

|---|---|---|

|

$ |

$ |

|

|

Depreciation: |

||

|

Buildings and building improvements |

4 855 408 |

4 392 129 |

|

Property, plant and equipment |

1 045 283 |

862 760 |

|

Heritage and cultural assets |

10 388 240 |

10 206 372 |

|

Exhibitions |

2 715 904 |

2 666 728 |

|

Total depreciation |

19 004 835 |

18 127 989 |

|

Amortisation: |

||

|

Intangibles (computer software) |

819 762 |

764 470 |

|

Total amortisation |

819 762 |

764 470 |

|

Total depreciation and amortisation |

19 824 597 |

18 892 459 |

|

Asset write-downs and impairment from: |

||

|---|---|---|

|

Impairment of receivables |

19 854 |

205 |

|

Impairment of inventories |

40 677 |

5 159 |

|

Total write-down and impairment of assets |

60 531 |

5 364 |

5. INCOME

5A. Sale of goods and rendering of services

|

Sale of goods in connection with |

||

|---|---|---|

|

Related parties |

55 045 |

46 907 |

|

External parties |

2 980 555 |

2 517 955 |

|

Total sale of goods |

3 035 600 |

2 564 862 |

|

Rendering of services in connection with |

||

|

Related parties |

186 632 |

39 404 |

|

External parties |

1 753 289 |

1 757 230 |

|

Total rendering of services |

1 939 921 |

1 796 634 |

|

Total sale of goods and rendering of services |

4 975 521 |

4 361 496 |

5B. Resources received free of charge

|

Resources received free of charge in relation to |

||

|---|---|---|

|

Related parties |

17 862 |

102 222 |

|

External parties |

778 646 |

990 851 |

|

Total resources received free of charge |

796 508 |

1 093 073 |

|

2015 |

2014 |

|

|---|---|---|

|

$ |

$ |

5C. Donations and sponsorships

|

Donations |

4 719 365 |

2 188 869 |

|---|---|---|

|

Sponsorships |

5 611 806 |

1 021 515 |

|

Donated collection items |

488 701 |

208 150 |

|

Total donations and sponsorships |

10 819 872 |

3 418 534 |

5D. Other revenue

|

Friends of the Memorial |

150 372 |

162 449 |

|---|---|---|

|

Royalties and licensing income |

108 546 |

40 949 |

|

Rental income |

113 734 |

- |

|

Other |

8 014 |

10 000 |

|

Total other revenue |

380 666 |

213 398 |

5E. Revenue from Government

Department of Veterans' Affairs

|

Corporate entity payment item |

44 008 000 |

40 900 000 |

|---|---|---|

|

Total revenue from Government |

44 008 000 |

40 900 000 |

6. Fair Value Measurements

The following tables provide an analysis of assets and liabilities that are measured at fair value. The different levels of the

fair value hierarchy are defined below.

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the Memorial can access at measurement date.

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.